Therefore, always consult with accounting and tax professionals for assistance with your specific circumstances. In the next lessons, we will illustrate how to prepare adjusting entries for each type and provide examples as we go. All adjusting entries include at least a nominal account and a real account. Several internet sites can provide additional information for you on adjusting entries. One very good site where you can find many tools to help you study this topic is Accounting Coach which provides a tool that is available to you free of charge. Visit the website and take a quiz on accounting basics to test your knowledge.

Accrued Expenses

Previously unrecorded service revenue can arise when a companyprovides a service but did not yet bill the client for the work.This means the customer has also not yet paid for services. Sincethere was no bill to trigger a transaction, an adjustment isrequired to recognize revenue earned at the end of the period. Adjusting entries requires updates to specific account types atthe end of the period. Not all accounts require updates, only thosenot naturally triggered by an original source document. There aretwo main types of adjusting entries that we explore further,deferrals and accruals. This account is a non-operating or “other” expense for the cost of borrowed money or other credit.

Unearned Revenues

Unearned revenue, for instance, accounts for money received for goods not yet delivered. Accruals are revenues and expenses that have not been received or paid, respectively, and have not yet been recorded through a standard accounting transaction. For instance, an accrued expense may be rent that is paid at the end of the month, even though a firm is able to occupy the space at the beginning of the month that has not yet been paid. Overall, adjustment entries play a crucial role in ensuring the accuracy and reliability of financial statements. Companies that take the time to properly record and adjust their accounts will be better equipped to make informed business decisions and meet their financial obligations. Adjustment entries are an important tool for businesses to ensure that their financial statements are accurate.

Great! The Financial Professional Will Get Back To You Soon.

To record a deferral, an accountant would debit an asset account and credit a revenue or expense account. Supplies Expense is an expense account, increasing (debit) for$150, and Supplies is an asset account, decreasing (credit) for$150. This means $150 is transferred from the balance sheet (asset)to the income statement (expense). The balances in the Supplies and Supplies Expenseaccounts show as follows. One of the main financial statements (along with the balance sheet, the statement of cash flows, and the statement of stockholders’ equity).

Accrued Revenue

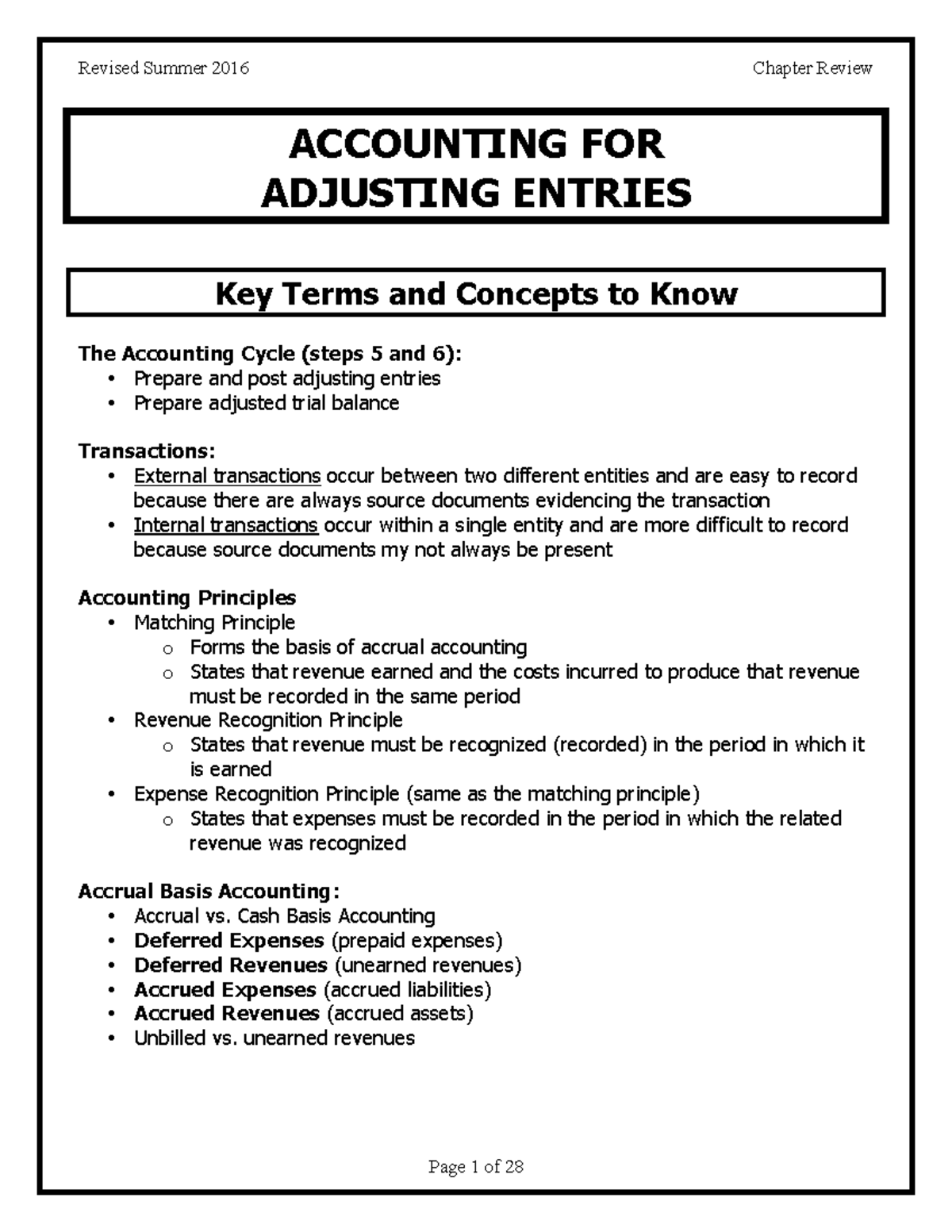

Adjustment entries are an important part of the accounting process that ensures financial statements are accurate and reflect the true financial position of a company. These entries are made at the end of an accounting period to update accounts that were not properly recorded during the period. Deferred revenue is revenue that has been received but not yet earned. To record deferred revenue, an adjusting entry is made to decrease the liability account and increase the corresponding revenue account. Accrued expenses are expenses that have been incurred but not yet paid. To record accrued expenses, an adjusting entry is made to increase the expense account and increase the corresponding liability account.

- A real account has a balance that is measured cumulatively, rather than from period to period.

- Once you have journalized all of your adjusting entries, the next step is posting the entries to your ledger.

- Accruals are revenues and expenses that have not been received or paid, respectively, and have not yet been recorded through a standard accounting transaction.

- The choice of method can impact the financial statements and tax liabilities.

Even though not all ofthe $48,000 was probably collected on the same day, we record it asif it was for simplicity’s sake. Insurance policies can require advanced payment of fees forseveral months at a time, six months, for example. The company doesnot use all six months of insurance immediately but over the courseof the six months.

Journal entries are recorded when an activity or event occursthat triggers the entry. Recall that an original source can be a formal documentsubstantiating a transaction, such as an invoice, purchase order,cancelled check, or employee time sheet. Not every transactionproduces an original source document that will alert the bookkeeperthat it is time to make an entry. The primary objective of accounting risk response plan is to provide information that will help management take better decisions and plan for the future. It also helps users (lenders, employees and other stakeholders) to assess a business’s financial performance, financial position and ability to generate future Cash Flows. The updating/correcting process is performed through journal entries that are made at the end of an accounting year.

At the end of the month, the company took an inventory ofsupplies used and determined the value of those supplies usedduring the period to be $150. A related account is Insurance Expense, which appears on the income statement. The amount in the Insurance Expense account should report the amount of insurance expense expiring during the period indicated in the heading of the income statement. Liabilities also include amounts received in advance for a future sale or for a future service to be performed. Adjusting Entries refer to those transactions which affect our Trading Account (profit and loss account) and capital accounts (balance sheet). Closing entries relate exclusively with the capital side of the balance sheet.

When a purchase return is partly returned by the customer, it is treated as a payment on account of the balance. It means that for this part, the supplier has received only a part of the amount due to him/her. In such cases, therefore an overdraft would be created in his books of accounts and he will have to adjust it when he receives the balance by making an adjusting entry. If you use accounting software, you’ll also need to make your own adjusting entries.

At the end of each month, the company needs torecord the amount of insurance expired during that month. Depreciation Expense increases (debit) and AccumulatedDepreciation, Equipment, increases (credit). If the company wantedto compute the book value, it would take the original cost of theequipment and subtract accumulated depreciation. For example, let’s say a company pays $2,000 for equipment thatis supposed to last four years.